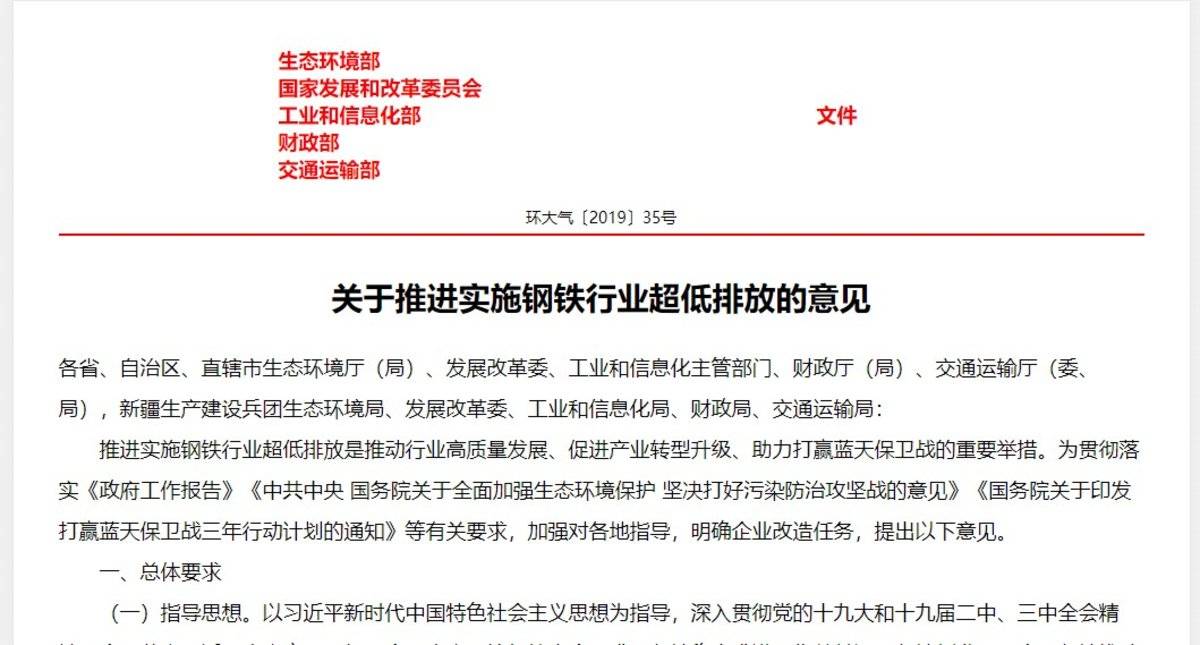

State Taxation Administration of The People’s Republic of China order

No.56

The Decision of State Taxation Administration of The People’s Republic of China on Amending the Detailed Rules for the Implementation of the Measures for the Administration of Invoices in People’s Republic of China (PRC), which was considered and adopted at the 3rd executive meeting in State Taxation Administration of The People’s Republic of China on December 29th, 2023, is hereby promulgated and shall come into force as of March 1st, 2024.

Director State Taxation Administration of The People’s Republic of China: Hu Jinglin.

January 15, 2024

In order to ensure the effective implementation of the Measures for the Administration of Invoices in People’s Republic of China (PRC) (hereinafter referred to as the Measures), State Taxation Administration of The People’s Republic of China has decided to make the following amendments to the Detailed Rules for the Implementation of the Measures for the Administration of Invoices in People’s Republic of China (PRC):

One article is added as Article 3: "The electronic invoice mentioned in Article 3 of the Measures refers to the receipt and payment vouchers issued and collected in the form of data messages in accordance with the provisions of the tax authorities on invoice management in the purchase and sale of commodities, provision or acceptance of services and other business activities.

"Electronic invoices have the same legal effect as paper invoices, and no unit or individual may refuse them."

Two, one article is added as Article 4: "The tax authorities shall build an electronic invoice service platform to provide digital electronic invoice issuance, delivery, inspection and other services for ticket users and individuals."

Three, one article is added as Article 5: "The tax authorities shall, in accordance with the provisions of laws and administrative regulations, establish and improve the invoice data security management system to ensure the safety of invoice data.

"Units and individuals shall carry out invoice data processing activities in accordance with the relevant provisions of State Taxation Administration of The People’s Republic of China, undertake the obligation of invoice data security protection according to law, and shall not store invoice data in excess of the specified amount, and shall not use, illegally sell or illegally provide invoice data to others in violation of regulations."

4. Article 4 is renumbered as Article 7, and the first paragraph is amended as: "The basic contents of an invoice include: invoice name, invoice code and number, serial number and purpose, customer name, bank and account number, commodity name or business item, unit of measurement, quantity, unit price, amount in words and figures, tax rate (collection rate), tax amount, drawer, billing date and name of billing unit (individual).

5. Article 5 is renumbered as Article 8 and amended as: "An invoice-receiving entity may request the tax authorities in writing to use the invoice with its name printed on it, and the tax authorities shall confirm the type and quantity of the invoice with its name printed on it according to Article 15 of the Measures."

6. Article 6 is renumbered as Article 9 and amended as: "The tax authorities shall supervise and manage the enterprises that print invoices according to the requirements of government procurement contracts and the management of anti-counterfeiting products for invoices."

7. Article 10 is renumbered as Article 13, and the first paragraph is amended as: "The tax authorities that supervise the production of invoices shall issue a notice of invoice printing as required, and the printing enterprises must print as required."

VIII. Article 13 is renumbered as Article 16, and the first paragraph is amended as follows: "The special seal for invoices mentioned in Article 15 of the Measures refers to the seal with the words of its name, unified social credit code or taxpayer identification number and special seal for invoices stamped by the units and individuals receiving invoices when they issue paper invoices."

9. Article 15 is renumbered as Article 18 and amended as: "The methods of collection mentioned in Article 15 of the Measures refer to the methods of batch supply, exchange of the old and bring in the new, inspection of the old and bring in the new, and determination of the quota.

"The tax authorities determine or adjust the type, quantity, amount and method of collecting invoices according to the tax risk degree, tax credit level and actual business situation of units and individuals."

Ten, delete sixteenth, eighteenth, twenty-first, twenty-second, twenty-third, thirty-seventh.

XI. One article is added as Article 25: "The amount stipulated in Article 19 of the Measures shall not be changed, including the unit price and quantity involved in the calculation of the amount."

12. Article 27 is renumbered as Article 26 and amended as: "After the paper invoice is issued, if it is necessary to void the invoice, such as sales return, wrong invoicing, suspension of taxable services, etc., the original invoice shall be recovered and marked with the word’ void’, and then the invoice shall be void.

"After issuing a paper invoice, if it is necessary to issue a red-ink invoice in case of sales return, wrong invoicing, suspension of taxable services, sales discount, etc., it shall recover all the original invoices and indicate the words’ red-ink’ before issuing a red-ink invoice. If it is impossible to recover all the original invoices, it shall issue a red-ink invoice after obtaining the valid certificate of the other party. "

13. One article is added as Article 27: "After issuing an electronic invoice, in case of sales return, incorrect invoicing, suspension of taxable services, sales discount, etc., a red-ink invoice shall be issued in accordance with the regulations."

Article 28 is amended as: "When issuing invoices, units and individuals shall fill in complete items and true contents.

"Paper invoices should be filled out in the order of invoice numbers, with clear handwriting, all printed at one time, and the contents are exactly the same, and the invoice joint and deduction joint should be stamped with the special invoice seal."

15. One article is added as Article 29: "Inconsistency with the actual business operation mentioned in Article 21 of the Measures refers to one of the following acts:

"(1) Issuing or obtaining invoices without buying or selling commodities, providing or receiving services or engaging in other business activities;

"(2) buying or selling commodities, providing or accepting services, or engaging in other business activities, but the buyer, seller, commodity name, business items, amount, etc. specified in the invoices issued or obtained are inconsistent with the actual situation."

16. One article is added as Article 31: "Units and individuals providing services such as collecting and issuing invoices to clients shall be subject to the supervision of the tax authorities, and the maximum amount of invoice data stored shall comply with the provisions of the tax authorities."

17. One article is added as Article 32: "If an electronic invoice information system is developed to provide tax-related services such as query, download, storage and use of invoice data for others, it shall comply with the data standards and management regulations of the tax authorities, and sign an agreement with the client, and shall not use the invoice data beyond the authorized scope."

18. One article is added as Article 34: "Identity verification as mentioned in Article 26 of the Measures means that when units and individuals collect, issue and issue invoices on their behalf, their handlers should pay taxes under their real names."

19. One article is added as Article 36: "The tax authorities may extract, transfer, consult and copy invoice data during invoice inspection."

Twenty, Article 34 is changed to Article 39, which is amended as: "If the tax authorities punish acts that violate the laws and regulations on invoice management according to law, the tax authorities at or above the county level shall decide; If the fine is less than 2,000 yuan, it may be decided by the tax office. "

21. One article is added as Article 40: "Where Item 6 of Article 33 of the Measures stipulates that other vouchers are used instead of invoices, including:

"(a) invoices should be issued without invoices, and other vouchers should be used instead of invoices;

"(2) invoices should be obtained but not obtained, and other vouchers other than invoices or self-made vouchers should be used for tax deduction, export tax rebate, pre-tax deduction and financial reimbursement;

"(three) to obtain invoices that do not meet the requirements for tax deduction, export tax rebate, pre-tax deduction and financial reimbursement.

"If it constitutes evasion of tax payment, fraudulent export tax refund or false invoicing, it shall be implemented in accordance with the relevant provisions of the People’s Republic of China (PRC) Tax Collection and Management Law and the Measures."

22. Article 35 is changed into Article 41 and amended as: "The announcement mentioned in Article 38 of the Measures means that the tax authorities shall announce the taxpayer’s illegal invoices in tax places or news media such as radio, television, newspapers, periodicals and the Internet. The contents of the announcement include: the name of the taxpayer, the unified social credit code or the taxpayer identification number, the place of business, and the specific circumstances of violating the invoice management regulations. "

Twenty-three, one article is added as Article 43: "The tax bureaus of cities with separate plans shall do a good job in invoice management with reference to the responsibilities of the tax bureaus of provinces, autonomous regions and municipalities directly under the Central Government in the Measures."

Twenty-four, third, seventh, fourteenth and thirty-first in the "invoice" is amended as "paper invoice".

Twenty-five, the name of the third chapter and fourteenth in the "purchase" is amended as "receiving".

In addition, the order of articles and individual words are adjusted and modified accordingly.

This decision shall come into force as of March 1, 2024.

The Detailed Rules for the Implementation of the Measures for the Administration of Invoices in People’s Republic of China (PRC) shall be revised accordingly and re-promulgated.

Detailed rules for the implementation of the measures for the administration of invoices in People’s Republic of China (PRC)

(Promulgated by Order No.25 of State Taxation Administration of The People’s Republic of China on February 14, 2011, the first amendment was made according to the Decision of State Taxation Administration of The People’s Republic of China on Amending the Detailed Rules for the Implementation of the Measures for the Administration of Invoices in People’s Republic of China (PRC) on December 27, 2014, and the second amendment was made according to the Decision of State Taxation Administration of The People’s Republic of China on Amending the Rules of Some Tax Departments on June 15, 2018, and the State Taxation Administration of The People’s Republic of China on July 24, 2019 announced the cancellation of a batch of taxes. The matters to be certified and the decision to abolish and modify some regulatory documents were revised for the third time according to the Decision of State Taxation Administration of The People’s Republic of China on Amending the Detailed Rules for the Implementation of the Measures for the Administration of Invoices in People’s Republic of China (PRC) on January 15, 2024.

- Chapter I General Provisions

Article 1 These Detailed Rules are formulated in accordance with the Measures for the Administration of Invoices in People’s Republic of China (PRC) (hereinafter referred to as the Measures).

Article 2 Invoices with uniform patterns throughout the country shall be determined by State Taxation Administration of The People’s Republic of China.

Invoices with uniform patterns within provinces, autonomous regions and municipalities directly under the Central Government shall be determined by the tax bureaus of provinces, autonomous regions and municipalities directly under the Central Government (hereinafter referred to as provincial tax bureaus).

Article 3 The electronic invoice mentioned in Article 3 of the Measures refers to the receipt and payment vouchers issued and collected in the form of data messages in accordance with the provisions of the tax authorities on invoice management in the purchase and sale of commodities, provision or acceptance of services and other business activities.

Electronic invoices and paper invoices have the same legal effect, and no unit or individual may refuse them.

Article 4 The tax authorities shall build an electronic invoice service platform to provide digital electronic invoice issuance, delivery, inspection and other services for ticket users and individuals.

Article 5 The tax authorities shall, in accordance with the provisions of laws and administrative regulations, establish and improve the invoice data security management system to ensure the invoice data security.

Units and individuals shall carry out invoice data processing activities in accordance with the relevant provisions of State Taxation Administration of The People’s Republic of China, undertake the obligation of invoice data security protection according to law, and shall not store invoice data in excess of the specified amount, and shall not use, illegally sell or illegally provide invoice data to others in violation of regulations.

Article 6 The basic forms of paper invoices include stub forms, invoice forms and bookkeeping forms. The stub shall be kept by the payee or the drawer for future reference; The invoice is combined by the payer or the drawee as the original payment voucher; Bookkeeping is made by the payee or the drawer as the original voucher for bookkeeping.

The tax authorities at or above the provincial level may, according to the management of paper invoices and the needs of taxpayers’ business operations, increase or decrease other invoices, and determine their uses.

Article 7 The basic contents of an invoice include: invoice name, invoice code and number, serial number and purpose, customer name, bank and account number, commodity name or business item, unit of measurement, quantity, unit price, amount in words and figures, tax rate (collection rate), tax amount, drawer, date of invoicing, name (seal) of billing unit (individual), etc.

The tax authorities at or above the provincial level may determine the specific contents of invoices according to the needs of economic activities and invoice management.

Article 8 An invoice-receiving entity may request the tax authorities in writing to use the invoice with its name printed on it, and the tax authorities shall confirm the type and quantity of the invoice with its name printed on it according to Article 15 of the Measures.

- Chapter II Printing of Invoices

Article 9 The tax authorities shall supervise and manage the enterprises that print invoices according to the requirements of government procurement contracts and the management of anti-counterfeiting products for invoices.

Article 10 The national unified anti-counterfeiting measures for paper invoices shall be determined by State Taxation Administration of The People’s Republic of China, and the provincial tax bureau may add anti-counterfeiting measures for paper invoices in the local area according to needs, and file them with State Taxation Administration of The People’s Republic of China.

Special anti-counterfeiting products for paper invoices shall be kept in special warehouses according to regulations and shall not be lost. Defective products and waste products shall be destroyed centrally under the supervision of tax authorities.

Article 11 The unified national invoice producer seal is the legal symbol for tax authorities to manage invoices, and its shape, specifications, content and printing color shall be stipulated by State Taxation Administration of The People’s Republic of China.

Twelfth nationwide invoice replacement is determined by State Taxation Administration of The People’s Republic of China; The replacement of invoices within provinces, autonomous regions and municipalities directly under the Central Government shall be determined by the Provincial Taxation Bureau.

When the invoice is changed, it shall be announced.

Article 13 The tax authorities that supervise the production of invoices shall, as required, issue a notice of printing invoices, and the printing enterprises must print them as required.

The invoice printing notice shall specify the name of the enterprise that printed the invoice, the name of the unit that used the invoice, the name of the invoice, the invoice code, the type, the serial number, the specification, the printing color, the printing quantity, the starting and ending numbers, the delivery time and place, etc.

Article 14 The finished products printed by an invoice printing enterprise shall be kept in a special warehouse after acceptance according to regulations, and shall not be lost. Waste products should be destroyed in time.

- Chapter III Collection of Invoices

Article 15 The identity certificate of the agent mentioned in Article 15 of the Measures refers to the resident identity card, passport or other documents that can prove the identity of the agent.

Article 16 The special seal for invoices mentioned in Article 15 of the Measures refers to the seal stamped by the units and individuals who receive invoices when they issue paper invoices with the words of their name, unified social credit code or taxpayer identification number and special seal for invoices.

The style of special invoice seal is determined by State Taxation Administration of The People’s Republic of China.

Article 17 The tax authorities shall keep the impression of the special seal for invoices provided by units and individuals who receive paper invoices for future reference.

Article 18 The methods of requisition mentioned in Article 15 of the Measures refer to the methods of batch supply, exchange of the old and bring in the new, inspection of the old and bring in the new, and determination of the quota.

The tax authorities determine or adjust the type, quantity, amount and method of receiving invoices according to the tax risk degree, tax credit level and actual business situation of units and individuals.

Article 19 The use of invoices mentioned in Article 15 of the Measures refers to the receipt and storage of invoices and related invoicing data.

Twentieth "written proof" as mentioned in Article 16 of the Measures refers to the relevant business contracts, agreements or other materials approved by the tax authorities.

Article 21 The tax authorities shall sign an agreement with the units entrusted to issue invoices on their behalf, specifying the types, objects, contents and related responsibilities of issuing invoices on their behalf.

- Chapter IV Issuance and Custody of Invoices

Article 22 Under special circumstances as mentioned in Article 18 of the Measures, the invoice issued by the payer to the payee refers to the following circumstances:

(1) When the purchasing unit and withholding agent pay personal money;

(2) State Taxation Administration of The People’s Republic of China believes that other invoices need to be issued by the payer to the payee.

Twenty-third retail small commodities to consumers or provide sporadic services, whether it can be exempted from issuing invoices one by one, is determined by the provincial tax bureau.

Twenty-fourth units and individuals who fill out invoices must issue invoices when business operations are confirmed. No invoices are allowed without business.

Article 25 The amount stipulated in Article 19 of the Measures shall not be changed, including the unit price and quantity involved in the calculation of the amount.

Article 26 After the paper invoice is issued, in case of sales return, wrong invoicing, suspension of taxable services, etc., if it is necessary to void the invoice, the original invoice shall be recovered and marked with the word "void" to void the invoice.

If it is necessary to issue a red-ink invoice after issuing a paper invoice, such as sales return, wrong invoicing, suspension of taxable services, sales discount, etc., it shall withdraw all the original invoices and indicate the word "red-ink" before issuing a red-ink invoice. If all copies of the original invoice cannot be recovered, a red-ink invoice shall be issued after obtaining the valid certificate of the other party.

Twenty-seventh after the issuance of electronic invoices, if sales are returned, invoicing is wrong, taxable services are suspended, sales are discounted, etc., red-ink invoices shall be issued in accordance with regulations.

Article 28 When issuing invoices, units and individuals shall fill in complete items and true contents.

Paper invoices shall be filled out in the order of invoice numbers, with clear handwriting, all printed in one copy, and the contents are completely consistent, and the invoice and deduction copies shall be stamped with the special invoice seal.

Article 29 "Inconsistency with actual business operation" as mentioned in Article 21 of the Measures refers to one of the following acts:

(1) Issuing or obtaining invoices without buying or selling commodities, providing or receiving services or engaging in other business activities;

(2) buying and selling commodities, providing or accepting services, and engaging in other business activities, but the buyer, seller, commodity name, business items and amount specified in the invoices issued or obtained are inconsistent with the actual situation.

Article 30 Invoices shall be issued in Chinese. National autonomous areas can use a national language commonly used in the local area at the same time.

Article 31 Units and individuals providing services such as collecting and issuing invoices to clients shall be subject to the supervision of the tax authorities, and the maximum amount of invoice data stored shall comply with the provisions of the tax authorities.

Article 32 Where an electronic invoice information system is developed to provide tax-related services such as query, download, storage and use of invoice data for others, it shall comply with the data standards and management regulations of the tax authorities, and sign an agreement with the client, and shall not use invoice data beyond the authorized scope.

Thirty-third "measures" mentioned in article twenty-fifth of the provisions of the use of the region refers to the State Taxation Administration of The People’s Republic of China and the provincial tax bureau of the region.

Article 34 The identity verification mentioned in Article 26 of the Measures refers to that when units and individuals collect, issue and issue invoices on their behalf, their handlers should pay taxes under their real names.

Thirty-fifth units and individuals that use paper invoices shall properly keep the invoices. When the invoice is lost, it shall be reported to the tax authorities in writing on the day when the loss is found.

- Chapter V Inspection of Invoices

Article 36 The tax authorities may extract, transfer, consult and copy invoice data during invoice inspection.

Thirty-seventh "measures" mentioned in Article 31 of the invoice for the ticket is limited to use in the county (city). When it is necessary to transfer invoices from other counties (cities) for inspection, it shall be submitted to the tax authorities of the county (city) for receipt of invoices.

Thirty-eighth units and individuals who use tickets have the right to apply to the tax authorities to identify the authenticity of invoices. The tax authorities that receive the application shall accept and be responsible for identifying the authenticity of the invoice; If it is difficult to identify, it may be submitted to the tax authorities under invoice supervision for assistance in identification.

Invoices seized at the scene of forgery or alteration, as well as at the place of sale and storage, shall be identified by the local tax authorities.

Thirty-ninth tax authorities to punish acts in violation of invoice management regulations according to law, decided by the tax authorities at or above the county level; A fine of less than 2000 yuan may be decided by the tax office.

Article 40 Where Item 6 of Article 33 of the Measures stipulates that other vouchers shall be used instead of invoices, including:

(a) invoices should be issued without invoices, and other vouchers should be used instead of invoices;

(2) The invoices should be obtained but not obtained, and other vouchers other than invoices or self-made vouchers are used for tax deduction, export tax rebate, pre-tax deduction and financial reimbursement;

(three) to obtain invoices that do not meet the requirements for tax deduction, export tax rebate, pre-tax deduction and financial reimbursement.

Those who evade paying taxes, defraud export tax rebates or falsely issue invoices shall be implemented in accordance with the relevant provisions of the People’s Republic of China (PRC) Tax Collection and Management Law and the Measures.

Article 41 The term "announcement" as mentioned in Article 38 of the Measures means that the tax authorities shall announce the taxpayer’s illegal invoices in tax places or news media such as radio, television, newspapers, periodicals and the Internet. The contents of the announcement include: the name of the taxpayer, the unified social credit code or the taxpayer identification number, the place of business, and the specific circumstances of violating the invoice management regulations.

Article 42 If a violation of the invoice management regulations is serious enough to constitute a crime, the tax authorities shall transfer it to judicial organs for handling according to law.

- Chapter VII Supplementary Provisions

Article 43 The tax bureaus of cities under separate state planning shall do a good job in invoice management with reference to the responsibilities of the tax bureaus of provinces, autonomous regions and municipalities directly under the Central Government in the Measures.

Article 44 These Rules shall come into force as of February 1, 2011.